Summertime Tax Tips

Summertime and the living is easy...but did you know that gardens aren't the only thing you can grow, this is also a great time to make your tax return grow for this years taxes? According to bankrate.com here are 3 things to remember.

- Planning some home improvements? Summer is a great time to make your home more energy efficient. It could help reduce not only your utility bills, but also what you owe the IRS. You can make relatively easy and inexpensive upgrades, such as adding insulation or replacing leaky windows, and possibly receive a $500 tax credit on your 2013 tax return. More extensive -- and expensive -- alternative energy improvements will get you bigger tax breaks. These include installing solar energy, wind power, fuel cell or geothermal systems. Eligible home energy improvements in these areas could qualify for a tax credit equal to 30 percent of the cost, including installation, without any cap on the credit amount.

- Cleaning out the garage or the kids rooms? Your favorite nonprofit organization will happily take your money or unwanted household items any time of the year.In fact, summer is when many charities are struggling, as most folks tend to spend this season thinking about their own recreational wants instead of other people's needs.So help out the charities of your choice by donating now instead of waiting until the end of the year. If you itemize, your deduction is just as valid in July as it is in December. Just be sure to get a receipt and put it in your newly created tax-filing system. The IRS now demands documentation for every monetary charitable gift, regardless of how small or large. Without it, the IRS could disallow your deduction.Most working parents are well aware they can claim the child and dependent care credit to help cover day care expenses for the kids. But don't forget about day camp costs during summer.

- Kids at day camp? When school's out, day camps are a good substitute for or supplement to regular child care options. The IRS thinks so, too. It allows you to count the day camp costs toward your child care credit claim.Remember, only day camps qualify, no overnight kiddie retreats at the lake. But if you did take advantage of this short-term child care help, hang on to those receipts so you can count them when you file your taxes next year.

More From WWMJ Ellsworth Maine

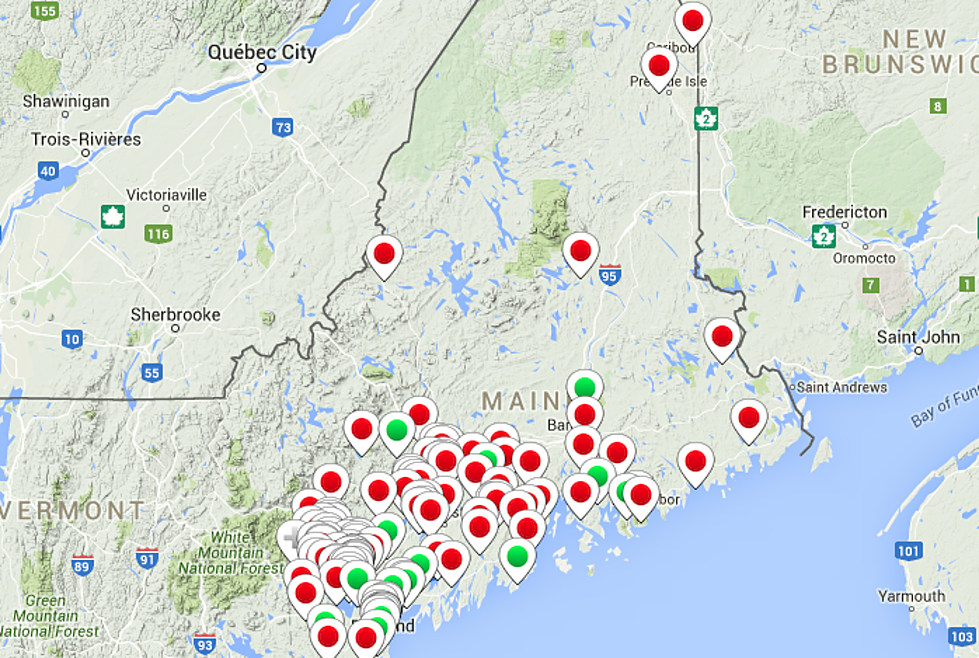

![It’s Not Too Late: Find a Maine Summer Camp Here! [MAP]](http://townsquare.media/site/696/files/2016/05/Screen-Shot-2016-05-03-at-5.45.55-PM.png?w=980&q=75)