When Is Your Child Ready To Have A Credit Card?

I remember when I was in high school I was told by my economics teacher that credit card debt fanned the flamed of inflation and that economically thy were a bad idea. I don’t know if my parents used them we never “had the talk” Wow, how times have changed. An exclusive survey of 500 parents with children under the age of 12, conducted for CardRatings.com by Op4G, found that some parents believe it's best to get children in the habit of using credit while they are young, while others think it's a threshold their kids shouldn't cross until they are all grown up. Let's look at both sides of that opinion gap, along with some of the key lessons that should go along with introducing your children to using credit.

The survey shows that most parents have taught their kids about credit, but just barely. Of survey respondents, 55 percent said they had explained to their kids how credit cards work, but 45 percent said they have not.

Only 7 percent of survey respondents think it's OK for a pre-teen to have a credit card, while at the other extreme 19 percent don't ever plan to give their child a credit card. The most popular response was that college is the right time, with 43 percent of parents saying that's when they would let their kids have access to credit. Another 30 percent think high school is the right time.

And lookout ladies, the survey suggests that dads are a softer bunch than moms when it comes to giving kids access to credit. Over a quarter of moms -- 27 percent -- don't ever plan on letting their kids have access to a credit card, whereas just 11 percent of dads feel that way.

Every child is different, so the right time to entrust your children with credit cards will depend on their intellect and their emotional maturity.

More on Credit Card Debt

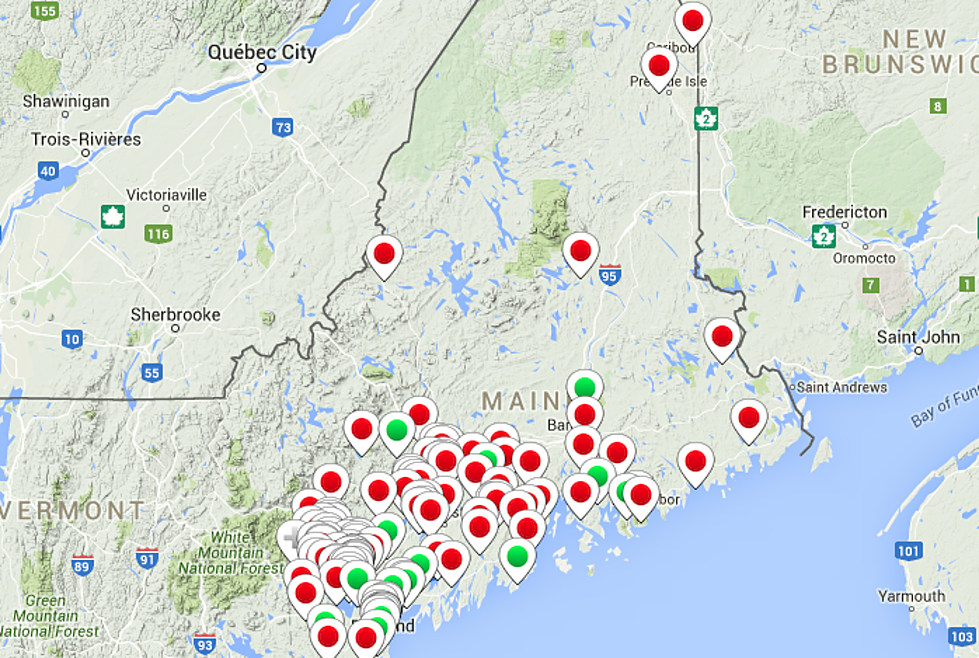

More From WWMJ Ellsworth Maine

![It’s Not Too Late: Find a Maine Summer Camp Here! [MAP]](http://townsquare.media/site/696/files/2016/05/Screen-Shot-2016-05-03-at-5.45.55-PM.png?w=980&q=75)